Fairfax, VA – May 15, 2023 – WidePoint Corporation (NYSE American: WYY), the Trusted Mobility Solutions company, reported results for the first quarter ended March 31, 2023.

First Quarter 2023 and Recent Operational Highlights:

- Executed a new contract to provide Mobile and Telecom Managed Services to a Standard & Poor’s 500 Food & Beverage company; WidePoint was selected to replace one of its competitors

- Entered into a reseller agreement with BK Technologies Corporation for the resale of BK’s InteropONE PTToC (Push-To-Talk Over Cellular) service to the U.S. Department of Homeland Security and the U.S. Department of State

- Intelligent Technology Management System, or ITMS™, has achieved FedRAMP in-process status

- Unified Communication Analytics solution set has been approved for the Microsoft commercial marketplace and has been launched in the Ingram Micro Marketplace

- Expanded credential issuing capabilities for customers to schedule credentialling appointments at any WidePoint facility

- Secured a substantial amount of “text capture” business as a result of a February 2023 mandate that federal agencies must preserve all government business communications including texts

- Implemented multiple commercial and federal customers from awards in Q4 and early Q1

- 45 total contractual actions resulting in over $34 million in annual contract value. New commercial contracts were $.6 million, new government awards were $9.1 million and government renewals were $24.3 million

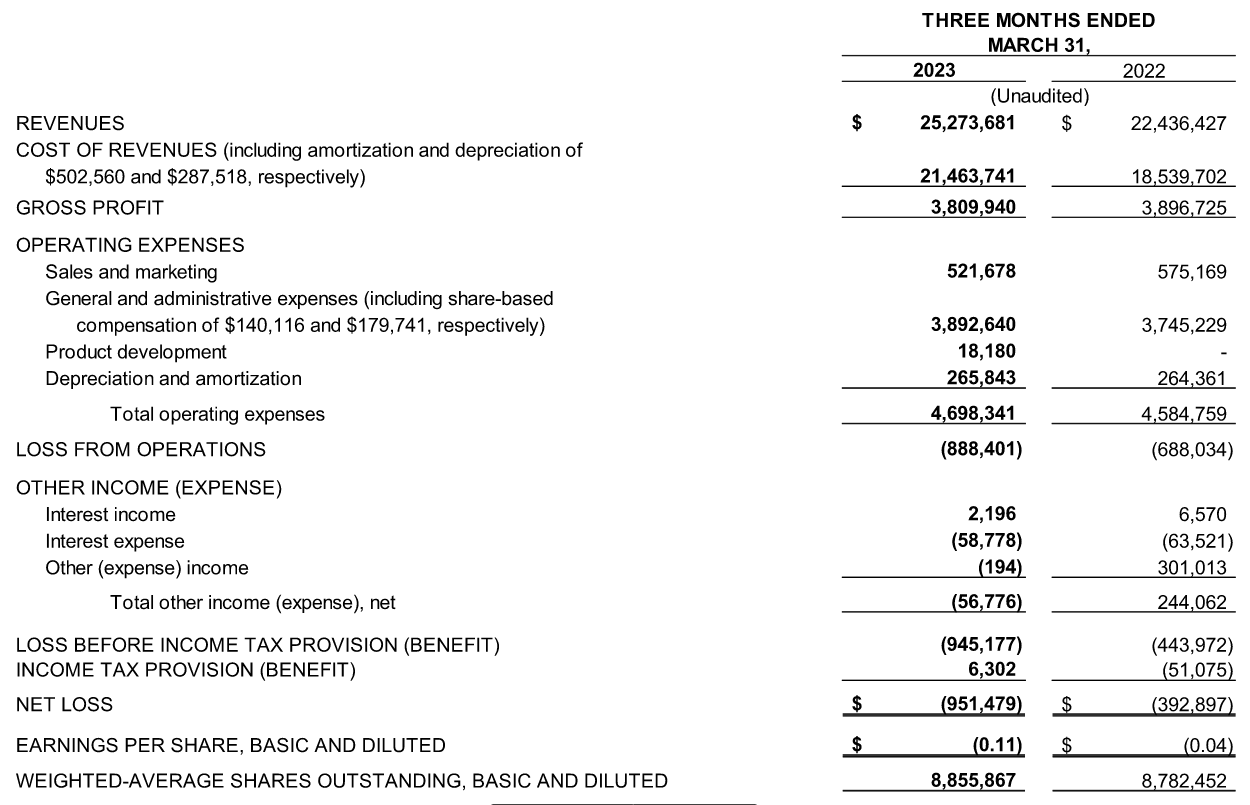

First Quarter 2023 Financial Highlights:

- Revenues were $25.3 million, a 13% increase from the same quarter last year

- Gross margin was 15%, and gross margin excluding carrier services revenue was 33%

- Net loss totaled $(951,000), or a loss of $(0.11) per diluted share

- Adjusted EBITDA, a non-GAAP financial measure, was $20,000

- As of March 31, 2023, cash and cash equivalents equaled $4.6 million

Management Commentary

“Thanks to the continuous ability of our team to execute, we achieved our 23rd consecutive quarter of being Adjusted EBITDA positive and concluded Q1 much better than we had anticipated both quantitatively and qualitatively,” said WidePoint CEO, Jin Kang. “Our progress in utilizing our network of partners to secure more contracts has significantly contributed to expediting the sales process. We remain positive and confident with the outlook for the remainder of the year, thanks to our accelerating sales and marketing efforts, proven stickiness of our valuable and indispensable solutions to existing customers, and business development initiatives.”

2023 Guidance

The collective factors noted above indicate that the company is witnessing favorable trends moving forward and is the basis behind its full year guidance range of $103 million to $108 million in revenue and $1.1 million to $1.5 million in adjusted EBITDA. The company expects a GAAP net loss of between $(2.8) million and $(3.2) million, or $(0.32) to $(0.36) loss per share, respectively. A major contributor to the loss per share is non-cash depreciation and amortization, which has increased as a result of prior capital investments being placed into service.

First Quarter 2023 Financial Summary

| THREE MONTHS ENDED MARCH 31, | ||

| (in millions, except per share amounts) | 2023 | 2022 |

| (unaudited) | ||

| Revenue |

$25.3

|

$22.4

|

| Gross Profit |

$3.8

|

$3.9

|

| Gross Profit Percentage |

15.1%

|

17.4%

|

| Operating Expenses |

$4.7

|

$4.6

|

| Loss from Operations |

(0.9)

|

(0.7) |

| Net Loss | (1.0) | (0.4) |

| Earnings per Share |

(0.11)

|

(0.04)

|

| EBITDA |

(0.12)

|

0.2

|

| Adjusted EBITDA |

0.020

|

0.344

|

Share Repurchase Program

The repurchase program remains on hold to preserve the company’s cash balance, as it looks to invest back into its technology and prepare for potential acquisitions. Longer-term, the company may leverage the buyback program when deemed appropriate.

Conference Call

WidePoint’s management will host the conference call today (May 15, 2023) at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss these results.

U.S. dial-in number: 888-506-0062

International number: 973-528-0011

Access Code: 727683

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Group at (949) 574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the company’s website.

A replay of the conference call will be available after 7:30 p.m. Eastern time on the same day through Monday, May 29, 2023.

Toll-free replay number: 877-481-4010

International replay number: 919-882-2331

Replay ID: 48181

About WidePoint

WidePoint Corporation (NYSE American: WYY) is a leading technology Managed Solution Provider (MSP) dedicated to securing and protecting the mobile workforce and enterprise landscape. WidePoint is recognized for pioneering technology solutions that include Identity and Access Management (IAM), Mobility Managed Services (MMS), Telecom Management, Information Technology as a Service (ITaaS), Cloud Security, and Analytics & Billing as a Service (ABaaS). For more information, visit widepoint.com.

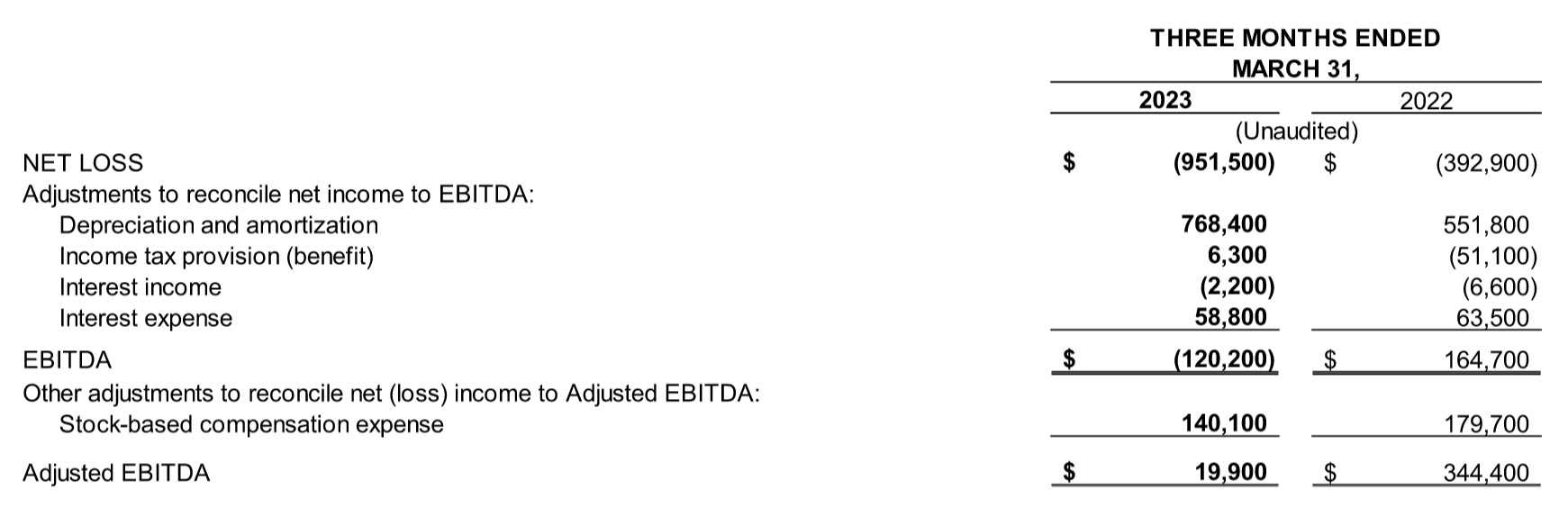

Non-GAAP Financial Measures

WidePoint uses a variety of operational and financial metrics, including non-GAAP financial measures such as EBITDA and Adjusted EBITDA, to enable it to analyze its performance and financial condition. The presentation of non-GAAP financial information should not be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. A reconciliation of GAAP Net income to EBITDA and Adjusted EBITDA is provided below:

WidePoint uses adjusted EBITDA as supplemental non-GAAP measure of performance. WidePoint defines EBITDA as net income excluding (i) interest expense, (ii) provision for or benefit from income taxes, (iii) depreciation and amortization, and (iv) Impairment charges. Adjusted EBITDA excludes certain amounts included in EBITDA. WidePoint is not providing a quantitative reconciliation of adjusted EBITDA in reliance on the “unreasonable efforts” exception for forward-looking non-GAAP measures set forth in SEC rules because certain financial information, the probable significance of which cannot be determined, is not available and cannot be reasonably estimated without unreasonable effort and expense. In this regard, WidePoint does not provide a reconciliation of forward-looking adjusted EBITDA (non-GAAP) to GAAP net income, due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation. Because certain deductions for non-GAAP exclusions used to calculate projected net income may vary significantly based on actual events, WidePoint is not able to forecast on a GAAP basis with reasonable certainty all deductions needed in order to provide a GAAP calculation of projected net income at this time. The amounts of these deductions may be material and, therefore, could result in projected GAAP net income being materially less than is indicated by estimated adjusted EBITDA (non-GAAP).

Safe Harbor Statement

This press release contains forward-looking statements concerning our business, operations and financial performance and condition as well as our plans, objectives and expectations for our business operations and financial performance and condition that are subject to risks and uncertainties. All statements other than statements of historical fact included herein are forward-looking statements. You can identify these statements by words such as “aim,” “anticipate,” “assume,” “believe,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “potential,” “positioned,” “predict,” “should,” “target,” “will,” “would” and other similar expressions that are predictions of or indicate future events and future trends. These forward-looking statements are based on current expectations, estimates, forecasts and projections about our business and the industry in which we operate and our management’s beliefs and assumptions. These statements are not guarantees of future performance or development and involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected, including, the impact of supply chain issues; our ability to successfully execute our strategy; our ability to sustain profitability and positive cash flows; our ability to access sufficient financing on acceptable terms given the tightening credit markets due to the current banking environment; our ability to gain market acceptance for our products; our ability to win new contracts, execute contract extensions and expand scope of services on existing contracts; our ability to compete with companies that have greater resources than us; our ability to penetrate the commercial sector to expand our business; our ability to identify potential acquisition targets and close such acquisitions; our ability to successfully integrate acquired businesses with our existing operations; our ability to maintain a sufficient level of inventory necessary to meet our customers demand due to supply shortage and pricing; our ability to retain key personnel; our ability to mitigate the impact of increases in interest rates; the impact of increasingly volatile public equity markets on our market capitalization; the impact and outcome of negotiations around the Federal debt ceiling; our ability to mitigate the impact of inflation; and The risk factors set forth in our Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on March 31, 2023.

The forward-looking statements included herein are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

Investor Relations:

Gateway Group, Inc.

Matt Glover or John Yi

949-574-3860

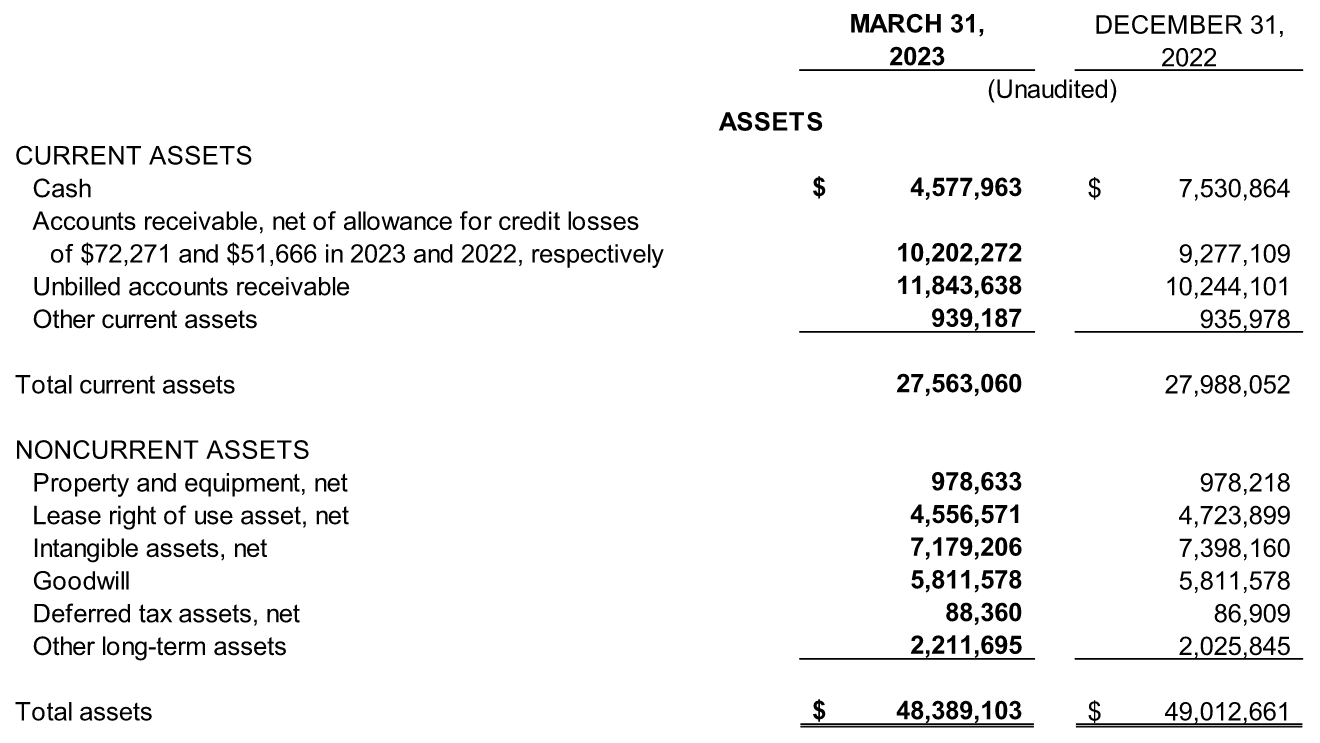

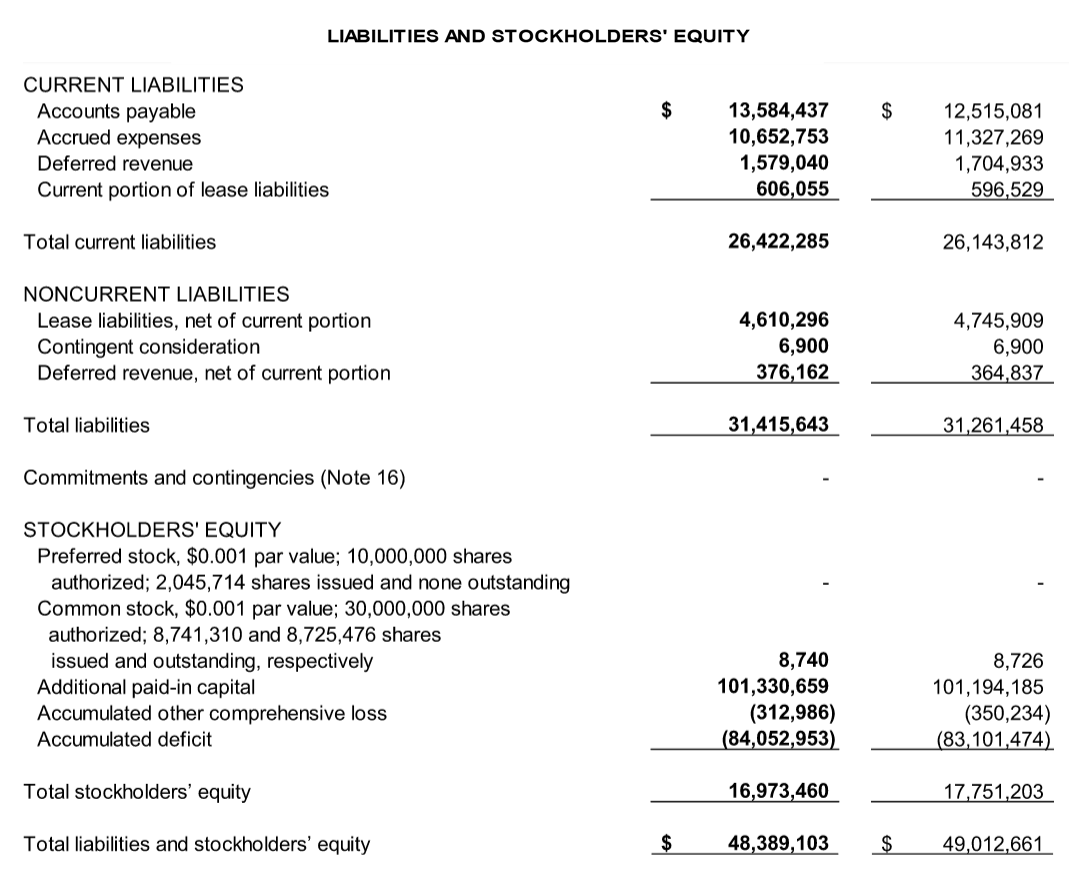

WIDEPOINT CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

WIDEPOINT CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

Back

Connect with

WidePoint

WidePoint’s Solutions are customized to each organization to deliver maximum value, enhanced security and data protection. No matter your industry or enterprise budget, WidePoint has the expertise needed to improve operational efficiency and reduce costs.

Contact WidePoint today to learn more!