Fairfax, VA – November 13, 2025 – WidePoint Corporation (NYSE American: WYY), a federally certified provider of Trusted Mobility Management (TM2) solutions, reported results for the third quarter ended September 30, 2025.

Third Quarter 2025 and Recent Operational Highlights:

- 33rd consecutive quarter of positive Adjusted EBITDA

- 8th consecutive quarter of positive free cash flow

- 8 Spiral 4 task orders awarded year-to-date; 4 task orders awarded in the third quarter 2025, including an award with the Defense Counterintelligence and Security Agency and the U.S. Army

- Secured estimated $40 million to $45 million SaaS contract to deliver FedRAMP-authorized ITMS platform for a major telecommunications carrier

- Awarded new CWMS 2.0 task order by U.S. Customs & Border Protection valued up to $27.5 million

- Subsidiary Soft-Ex announced strategic go-to-market alliance with Ingram Micro to optimize Microsoft license management

- Awarded new Identity & Access Management contract in support of the U.S. Department of Education

- Awarded new MobileAnchor contract by an agency under the U.S. Department of Energy

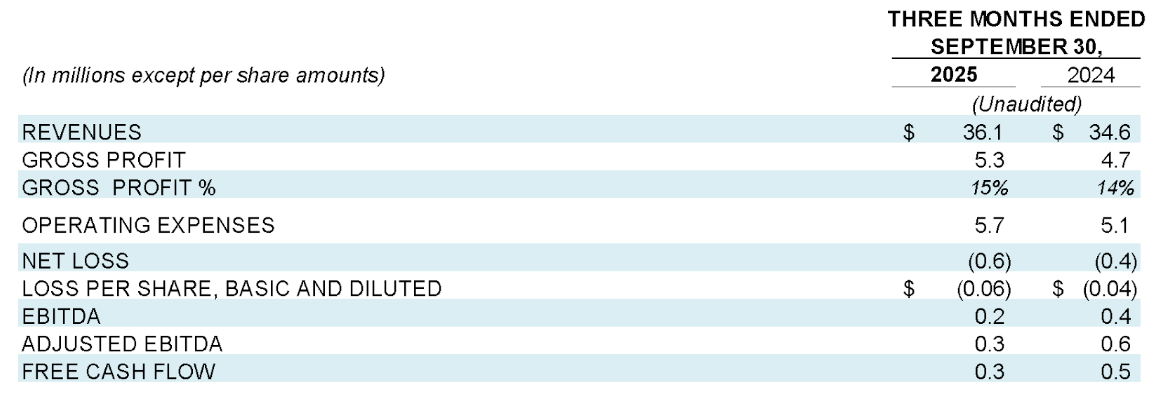

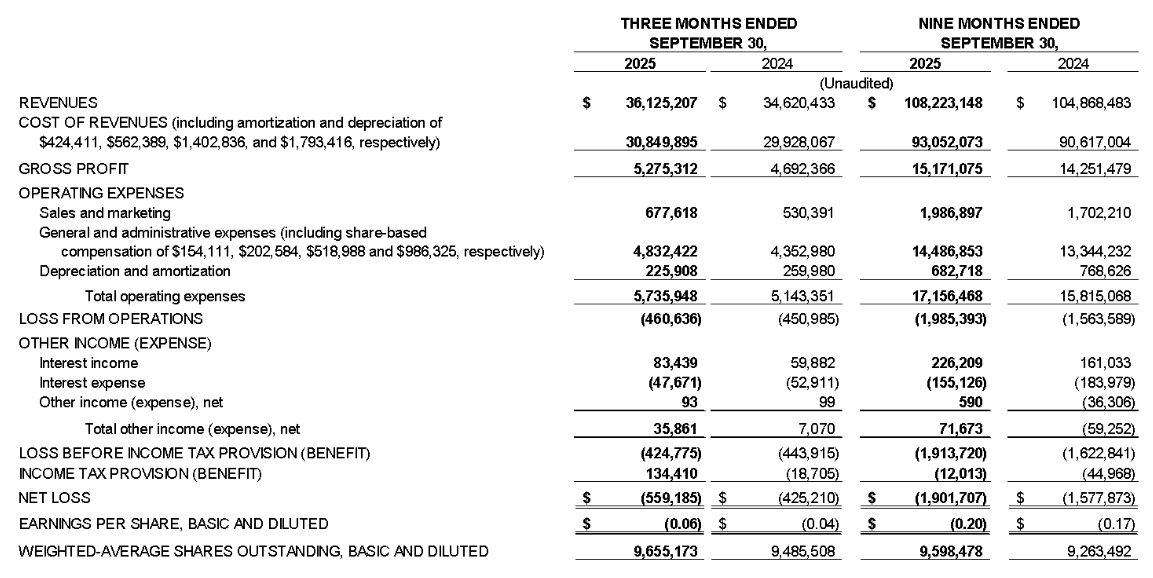

Third Quarter 2025 Financial Highlights:

- Revenues were $36.1 million, an increase from the same quarter last year

- Gross margin was 15%, and gross margin excluding carrier services revenue was 34%

- Net loss was $559,000 or a loss of $(0.06) per share

- Adjusted EBITDA1, a non-GAAP financial measure, was $344,000, an 88% increase from Q2 2025

- Free cash flow1, a non-GAAP financial measure, was $324,000, a 260% increase form Q2 2025

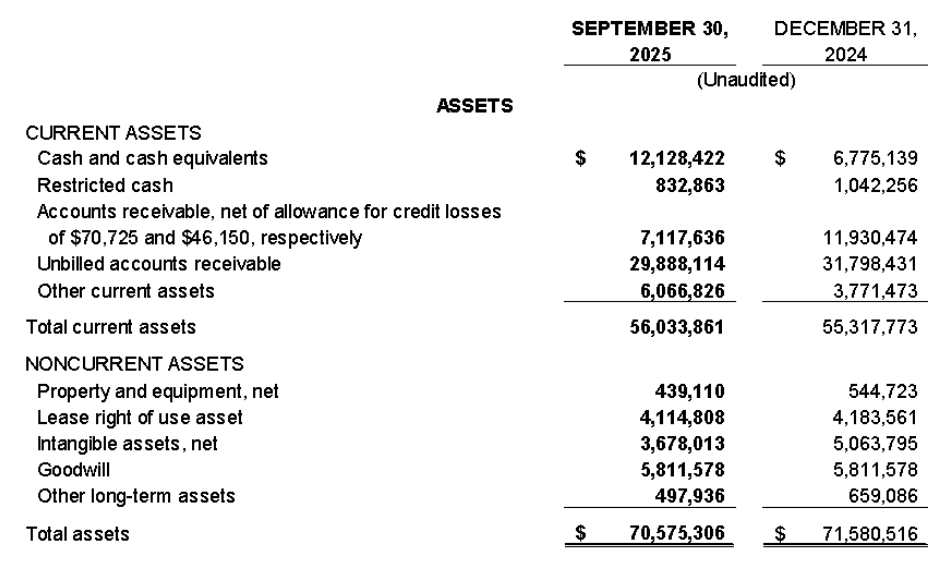

- As of September 30, 2025, unrestricted cash was $12.1 million with no bank debt

- As of September 30, 2025, contract backlog was approximately $269 million

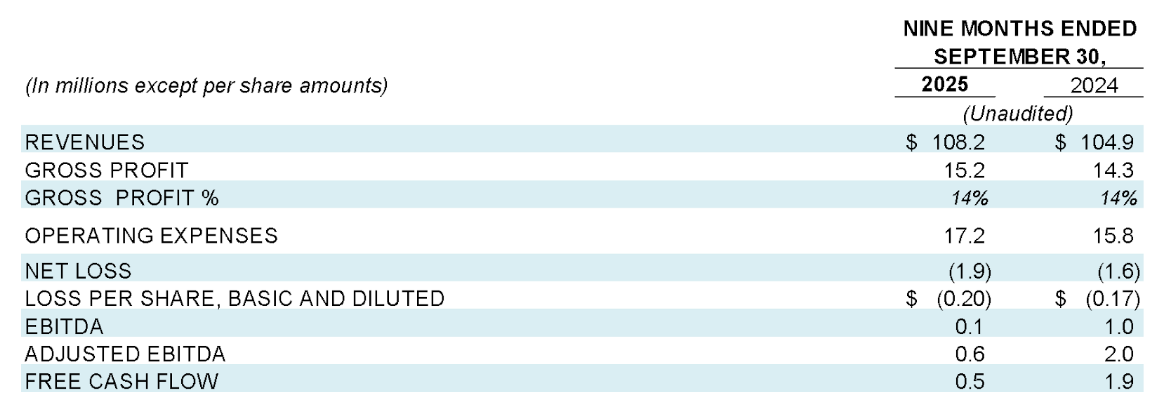

Nine Months 2025 Financial Highlights:

- Revenues were $108.2 million, an increase from the same period last year

- Gross margin was 14%, and gross margin excluding carrier services revenue was 35%

- Net loss was $1.9 million or a loss of $(0.20) per share.

- Adjusted EBITDA1, a non-GAAP financial measure, was $620,000

- Free cash flow1, a non-GAAP financial measure, was $479,000

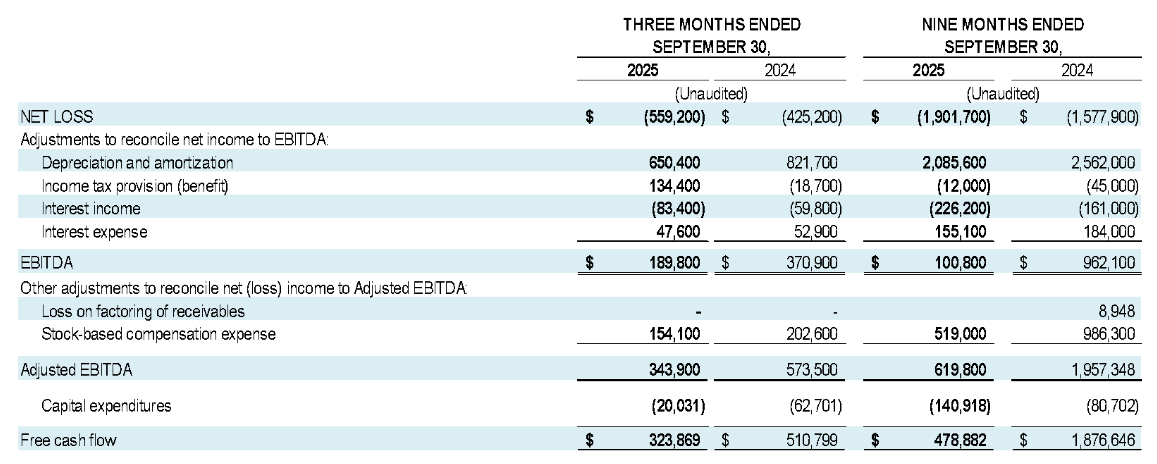

1 Free cash flow and Adjusted EBITDA are non-GAAP financial measures. See below for the definition of such measures and a reconciliation to GAAP.

Management Commentary

WidePoint CEO Jin Kang commented: “The strategic investments made throughout the first half of 2025 that we believed would serve as the foundation for sustainable growth have begun to bear fruit. Our adjusted EBITDA and free cash flow results reflect notable sequential growth. We believe we are back on the same growth trajectory we experienced last year and remain confident in continuing this upward trajectory throughout Q4 into 2026.

“The highlight of the last several months was our recent SaaS contract win to deliver our FedRAMP-authorized ITMS platform for a major telecommunications carrier. This single contract alone demonstrates the value of our early investment in FedRAMP, as it opens the door to many larger-scale, margin-accretive opportunities that we are actively pursuing to drive sustainable bottom-line results. This SaaS contract is just a glimpse of the margin-accretive opportunities that lie in our robust pipeline, and we look forward to continuing to execute and bringing these opportunities into fruition.

“On November 6, 2025, we were pleased that the final RFP for the upcoming CWMS 3.0 contract was released by DHS. Our initial review found that the requirements largely remained consistent with the draft RFP. This further reinforces our confidence in securing this contract once again. As we have continued to state, we believe we possess all the required certifications, meet every criterion, and with our strong past performance serving DHS, WidePoint is in the best position to capture this $3.0 billion opportunity. Typically, it takes approximately four months after the final RFP is issued for a winner to be announced. We are optimistically targeting the end of Q1 and early Q2 2026 to hear the results.

“Looking ahead, we remain excited in our Device-as-a-Service (DaaS) pipeline. We are continuing to invest in the underlying infrastructure to prepare for the multitude of impactful opportunities that are on the horizon. The DaaS pipeline consists of majority commercial clients and includes Fortune 100 companies that typically manage large fleets of devices. Securing even one of these opportunities in our pipeline has the potential to produce meaningful results for our bottom line. Spiral 4 activity is also continuing to trend in the right direction, with eight task orders awarded year-to-date and four awarded during the third quarter alone. We look forward to accelerating the growth seen this quarter into Q4 and carrying the momentum over to 2026.”

Third Quarter 2025 Financial Summary

Nine Month 2025 Financial Summary

Conference Call

WidePoint’s management will host the conference call today (November 13, 2025) at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss these results.

U.S. dial-in number: 888-506-0062

International number: 973-528-0011

Access Code: 554830

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Group at (949) 574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the company’s website.

A replay of the conference call will be available after 7:30 p.m. Eastern time on the same day through Thursday, November 27, 2025.

Toll-free replay number: 877-481-4010

International replay number: 919-882-2331

Replay ID: 53082

About WidePoint

WidePoint Corporation (NYSE American: WYY) is a leading technology Managed Solution Provider (MSP) dedicated to securing and protecting the mobile workforce and enterprise landscape. WidePoint is recognized for pioneering technology solutions that include Identity & Access Management (IAM), Mobility Managed Services (MMS), Telecom Management, Information Technology as a Service, Cloud Security, and Analytics & Billing as a Service (ABaaS). To learn more, visit https://www.widepoint.com.

Non-GAAP Financial Measures

WidePoint uses a variety of operational and financial metrics, including non-GAAP financial measures such as EBITDA, Adjusted EBITDA, and Free cashflow, to enable it to analyze its performance and financial condition. The presentation of non-GAAP financial information should not be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. A reconciliation of GAAP Net income to EBITDA and Adjusted EBITDA and Free cashflow is provided below:

WidePoint uses EBITDA, Adjusted EBITDA and Free cashflow as supplemental non-GAAP measure of performance. WidePoint defines EBITDA as net income excluding (i) interest expense, (ii) provision for or benefit from income taxes, (iii) depreciation and amortization, and (iv) Impairment charges. Adjusted EBITDA excludes certain amounts included in EBITDA such as stock-based compensation expense. WidePoint defined Free cashflow as Adjusted EBITDA less capital expenditures. Management believes that adjustments for certain non-cash or other items and the exclusion of certain pass-through revenue and expenses should enhance stockholders’ ability to evaluate the Company’s performance, as such measures provide additional insights into the factors and trends affecting its business. Therefore, the Company excludes these items from its GAAP financial measures to calculate these unaudited non-GAAP measures. These unaudited non-GAAP measures may not be comparable to similarly titled measures reported by other companies and should be considered in addition to, and not as a substitute for GAAP.

Safe Harbor Statement

This press release contains forward-looking statements concerning our business, operations and financial performance and condition as well as our plans, objectives and expectations for our business operations and financial performance and condition that are subject to risks and uncertainties. All statements other than statements of historical fact included herein are forward-looking statements. You can identify these statements by words such as “aim,” “anticipate,” “assume,” “believe,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “potential,” “positioned,” “predict,” “should,” “target,” “will,” “would” and other similar expressions that are predictions of or indicate future events and future trends. These forward-looking statements are based on current expectations, estimates, forecasts and projections about our business and the industry in which we operate and our management’s beliefs and assumptions. These statements are not guarantees of future performance or development and involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected, including, the impact of supply chain issues; our ability to successfully execute our strategy; our ability to sustain profitability and positive cash flows; our ability to access sufficient financing on acceptable terms given the tightening credit markets due to the current banking environment; our ability to gain market acceptance for our products; our ability to win new contracts, execute contract extensions and expand scope of services on existing contracts; our ability to compete with companies that have greater resources than us; our ability to penetrate the commercial sector to expand our business; our ability to identify potential acquisition targets and close such acquisitions; our ability to successfully integrate acquired businesses with our existing operations; our ability to maintain a sufficient level of inventory necessary to meet our customers demand due to supply shortage and pricing; our ability to retain key personnel; our ability to mitigate the impact of increases in interest rates; the impact of increasingly volatile public equity markets on our market capitalization; the impact and outcome of negotiations around the Federal debt ceiling; our ability to mitigate the impact of inflation; and the risk factors set forth in our Form 10-Q for the quarter ended September 30, 2025 filed with the SEC on November 13, 2025.

The forward-looking statements included herein are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

WidePoint Investor Relations:

Gateway Group, Inc.

Matt Glover or John Yi

949-574-3860

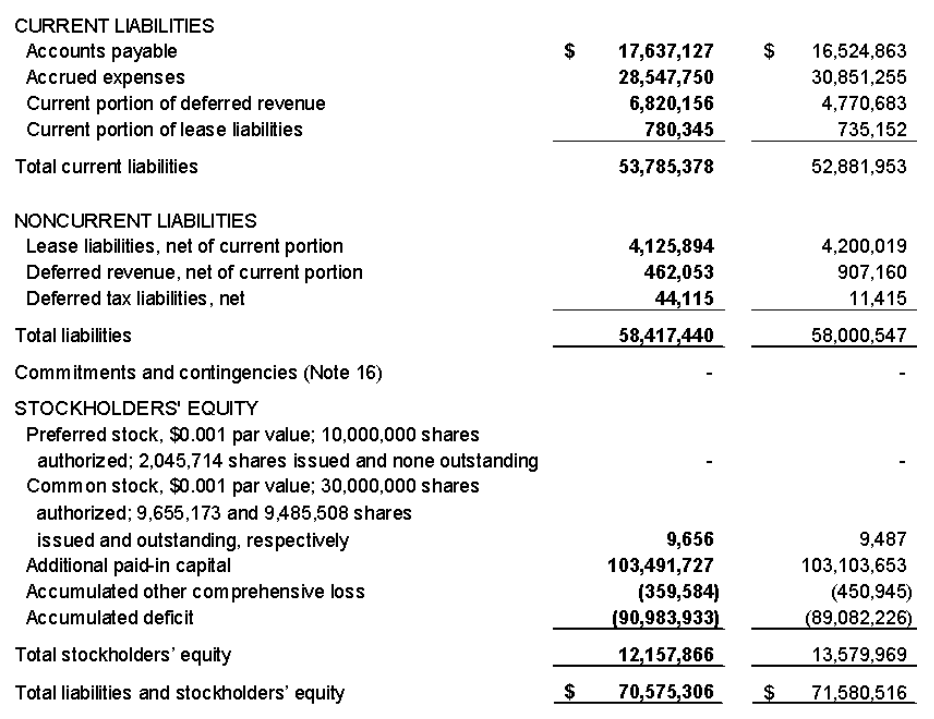

WIDEPOINT CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

LIABILITIES AND STOCKHOLDER’S EQUITY

WIDEPOINT CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

Back

Connect with

WidePoint

WidePoint’s Solutions are customized to each organization to deliver maximum value, enhanced security and data protection. No matter your industry or enterprise budget, WidePoint has the expertise needed to improve operational efficiency and reduce costs.

Contact WidePoint today to learn more!